3550 Lenox Rd NE

Suite 2550

Atlanta, Georgia 30326

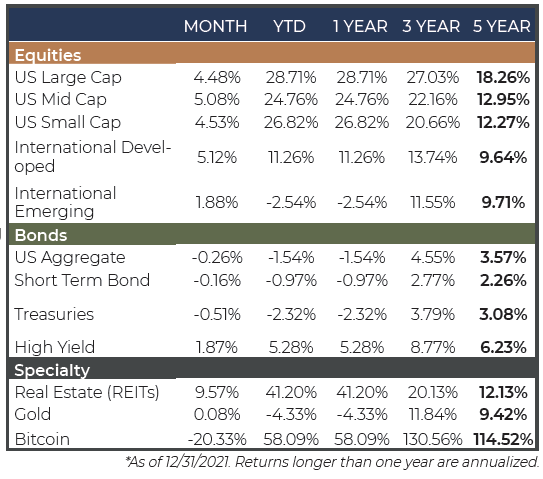

While the headlines continued to be dominated by a near constant barrage of negative news surrounding COVID spikes, rising inflation, and supply chain constraints, increased consumer spending, most notably in e-commerce, buoyed record earnings, sales and margins leading a 28.7% gain in the S&P 500 Index for the year 2021. This marks the 3rd strongest calendar year in the 13 years since the financial crisis of 2008.

Large cap stocks outperformed for the year, narrowly edging out small caps (+26.8%). International developed stocks trailed meaningfully during the year, up only 11.3% while emerging markets were negative on the year (-2.5%) driven primarily a significant downturn in China-based stocks (-21.2%). A slowdown in the Chinese property market combined with geopolitical tensions and nationalistic regulations led to economic concerns in the region.

Inflation pressures throughout 2021 have led to expectations of rising rates and shrinking government stimulus from the Federal Reserve’s asset purchasing program. Throughout the year, the yield on the 10-year treasury rose from below 1% to just over 1.5%. This upward move put pressure on bond prices leading the Bloomberg Aggregate Bond Index to fall by 1.5% during the year. Higher yielding corporate bonds fared better (+5.3%), supported by the stronger earnings. Despite the prospect for higher yields in 2022, investors still face historically low income generation from their bond portfolios. Higher inflation and potential for rising rates are likely to put further pressure on bonds in the coming months.

Crypto currencies, such as Bitcoin, have become increasingly popular as an investment opportunity. The high volatility can lead to meteoric rises in prices, but also hard selloffs in short periods of time. For the year, Bitcoin rose over 100% in value, but much of that was eroded towards the end of the year after a 40%+ drop in price. As crypto currencies become more accepted in the mainstream, expect increased scrutiny and regulations which could impact the investment thesis (positively or negatively) of this segment that is still finding its foothold as an accepted asset class.

As we enter the New Year, it appears that the “easy” money in equities has been made and that investors will likely be more discriminating given the risk of rising interest rates. A sharp move higher in rates would challenge equity valuations, particularly in the high multiple sectors with high leverage. We expect the key issues of inflation, supply chain challenges, political climate (mid-term elections) and COVID to continue to drive investor sentiment.

While these issues might seem to paint a dire picture, there is a positive scenario whereby inflation indicators begin to moderate before a significant tightening in monetary policy, thereby creating a more positive backdrop for equities and bonds. Also, despite the move higher in interest rates, Fed Funds rates and longer-term interest rates are still well below historical averages, leaving income investors short of meeting their objectives. Low yields and high equity valuations leave investors with a conundrum moving forward. Many investors will need to look to solutions that maximize the efficiency of their invested dollars in order to meet income and return needs without stretching their risk budgets. We do expect a bumpy path in 2022 and will continue to be diligent in managing risk while seeking opportunities provided by the market.

The statements contained herein are based upon the opinions of Bison Wealth, LLC (Bison) and the data available at the time of publication and are subject to change at any time without notice. This communication does not constitute investment advice and is for informational purposes only, is not intended to meet the objectives or suitability requirements of any specific individual or account, and does not provide a guarantee that the investment objective of any model will be met. An investor should assess his/ her own investment needs based on his/her own financial circumstances and investment objectives. Neither the information nor any opinions expressed herein should be construed as a solicitation or a recommendation by Bison or its affiliates to buy or sell any securities or investments or hire any specific manager. Bison prepared this Update utilizing information from a variety of sources that it believes to be reliable. It is important to remember that there are risks inherent in any investment and that there is no assurance that any investment, asset class, style or index will provide positive performance over time. Diversification and strategic asset allocation do not guarantee a profit or protect against a loss in a declining markets. Past performance is not a guarantee of future results. All investments are subject to risk, including the loss of principal.

Index definitions: “U.S. Large Cap” represented by the S&P 500 Index. “U.S. Small Cap” represented by the S&P 600 Index. “International” represented by the MSCI Europe, Australasia, Far East (EAFE) Net Return Index. “Emerging” represented by the MSCI Emerging Markets Net Return Index. “U.S. Aggregate” represented by the Bloomberg U.S. Aggregate Bond Index. “Treasuries” represented by the Bloomberg U.S. Treasury Bond Index. “Short Term Bond” represented by the Bloomberg 1-5 year gov/credit Index. “U.S. High Yield” represented by the Bloomberg U.S. Corporate High Yield Index. “Real Estate” represented by the Dow Jones REIT Index. “Gold” represented by the LBMA Gold Price Index. “Bitcoin” represented by the Bitcoin Galaxy Index.

3550 Lenox Rd NE

Suite 2550

Atlanta, Georgia 30326

Investment Advisory services are provided through Bison Wealth, LLC located at 3550 Lenox Road NE Suite 2550 Atlanta, GA 30326. Securities are offered through Metric Financial, LLC. located at 725 Ponce de Leon Ave. NE Atlanta, GA 30306, member FINRA/SIPC. Bison Wealth is not affiliated with Metric Financial, LLC. Bison Wealth is an independent investment adviser registered under the Investment Advisers Act of 1940, as amended. Registration does not imply a certain level of skill or training. Check the background of this investment professional on FINRA’s BrokerCheck. Bison Wealth, LLC does not offer tax or legal advice.

Investment adviser representatives affiliated with Metric Financial, LLC, a FINRA member broker-dealer, will earn commissions on certain investments. This presents a conflict of interest because the representative is incentivized to earn a commission. This conflict is mitigated, however, because you are not required to engage the IAR or Metric Financial, LLC to invest in securities. To the extent your IAR is affiliated with a broker-dealer, you may request copies of the Form CRS associated with the broker-dealer to better understand fees and services and how those fees and services differ from those provided by Bison Wealth, LLC. Any fees and/or commissions billed by Metric Financial, LLC are distinct from and in addition to fees billed by Bison Wealth, LLC.

Bison Wealth Form CRS | Form ADV Part 2 | Privacy Policy | Accessibility Statement