3550 Lenox Rd NE

Suite 2550

Atlanta, Georgia 30326

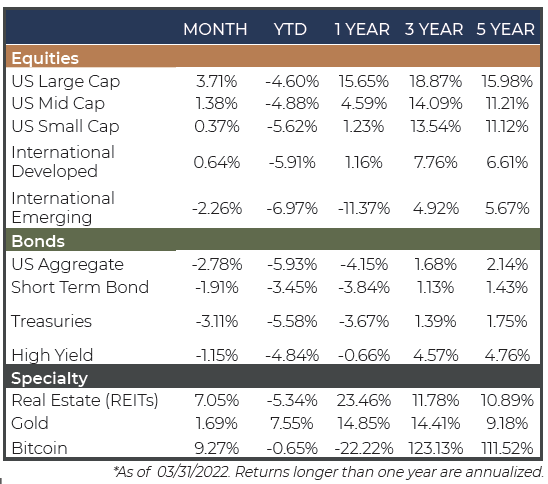

Inflationary pressures contributed to the negative sentiment in the technology and communication services sectors as they are perceived to be the most interest rate sensitive segments of the market. The negative returns in these sectors weighed heavily on the broader indices as they account for over 1/3 of the S&P 500 Index. The only bright spot for the quarter was the energy sector which spiked for all the wrong reasons. The war in Ukraine has stressed the global oil market supply given that Russia accounts for 10% of the world’s oil production. With major companies such as Shell and BP pulling out of Russia in response to the war as well as sanctions being placed across the Russian landscape, the price of oil spiked 45% during the quarter.

Q1 2022 proved to be an anomaly, at least historically speaking. It marks only the 3rd quarter in over 40 years when bond returns underperformed stocks in a quarter when stocks were negative. Inflation continued to be the key concern with signs that it may be more persistent than previously anticipated raising fears that the Fed may take more aggressive actions. With the direction of interest rates now priced in, the key question going forward will be the pace of monetary tightening and interest rate increases. Despite this quarter’s jump in rates, the 10 year treasury yield is just back to its pre-pandemic level which is still at the low end of its 20 year average (excluding pandemic period).

Real assets, led by oil, but inclusive of precious metals such as gold and silver produced positive returns during the quarter. Commodities, which are often viewed as a defense against inflationary environments, rose during the quarter as inflationary fears continued to mount. Investors defending against inflation combined with improving but still spotty supply chain constraints, helped push prices upward for the quarter. Crypto currencies continued their choppy run, with Bitcoin riding the waves down and back up during the quarter to end relatively flat.

From a macroeconomic perspective, there are a fair amount of positives. COVID cases continue to abate leading more of the economy to return to being fully open. The war in Ukraine has not had a significant impact as of yet on the global economy with the exception of the spike in oil prices. In spite of the known challenges, there are broad expectations we will continue to see economic growth in the near term.

In the first quarter, both stock and bond markets experienced a repricing as new information surrounding COVID, war in Ukraine, and inflation forced investors to recalibrate their expectations. With that information now largely priced in, markets can now react to better economic and earnings news. The primary risks in the market are now part of the picture rather than a shock to the picture.

This should not be confused with an assumption that nothing bad can happen. Each day the Fed speaks has the potential to deliver news inconsistent with expectations. War is inherently unpredictable leaving room for unexpected shocks. And COVID can always rear its ugly head again to put another crimp in supply chains and economic activity.

Economic fundamentals look strong, and with many of the shocks experienced during the first quarter being priced into the market, there is room for a positive outlook in the near term with the understanding that episodic volatility should be expected. Rather than timing that volatility, we continue to advocate for taking a long-term investment mindset, rooted in making efficient use of each invested dollar and ensuring proper risk management across any portfolio.

The statements contained herein are based upon the opinions of Bison Wealth, LLC (Bison) and the data available at the time of publication and are subject to change at any time without notice. This communication does not constitute investment advice and is for informational purposes only, is not intended to meet the objectives or suitability requirements of any specific individual or account, and does not provide a guarantee that the investment objective of any model will be met. An investor should assess his/ her own investment needs based on his/her own financial circumstances and investment objectives. Neither the information nor any opinions expressed herein should be construed as a solicitation or a recommendation by Bison or its affiliates to buy or sell any securities or investments or hire any specific manager. Bison prepared this Update utilizing information from a variety of sources that it believes to be reliable. It is important to remember that there are risks inherent in any investment and that there is no assurance that any investment, asset class, style or index will provide positive performance over time. Diversification and strategic asset allocation do not guarantee a profit or protect against a loss in a declining markets. Past performance is not a guarantee of future results. All investments are subject to risk, including the loss of principal.

Index definitions: “U.S. Large Cap” represented by the S&P 500 Index. “U.S. Small Cap” represented by the S&P 600 Index. “International” represented by the MSCI Europe, Australasia, Far East (EAFE) Net Return Index. “Emerging” represented by the MSCI Emerging Markets Net Return Index. “U.S. Aggregate” represented by the Bloomberg U.S. Aggregate Bond Index. “Treasuries” represented by the Bloomberg U.S. Treasury Bond Index. “Short Term Bond” represented by the Bloomberg 1-5 year gov/credit Index. “U.S. High Yield” represented by the Bloomberg U.S. Corporate High Yield Index. “Real Estate” represented by the Dow Jones REIT Index. “Gold” represented by the LBMA Gold Price Index. “Bitcoin” represented by the Bitcoin Galaxy Index.

3550 Lenox Rd NE

Suite 2550

Atlanta, Georgia 30326

Investment Advisory services are provided through Bison Wealth, LLC located at 3550 Lenox Road NE Suite 2550 Atlanta, GA 30326. Securities are offered through Metric Financial, LLC. located at 725 Ponce de Leon Ave. NE Atlanta, GA 30306, member FINRA/SIPC. Bison Wealth is not affiliated with Metric Financial, LLC. Bison Wealth is an independent investment adviser registered under the Investment Advisers Act of 1940, as amended. Registration does not imply a certain level of skill or training. Check the background of this investment professional on FINRA’s BrokerCheck. Bison Wealth, LLC does not offer tax or legal advice.

Investment adviser representatives affiliated with Metric Financial, LLC, a FINRA member broker-dealer, will earn commissions on certain investments. This presents a conflict of interest because the representative is incentivized to earn a commission. This conflict is mitigated, however, because you are not required to engage the IAR or Metric Financial, LLC to invest in securities. To the extent your IAR is affiliated with a broker-dealer, you may request copies of the Form CRS associated with the broker-dealer to better understand fees and services and how those fees and services differ from those provided by Bison Wealth, LLC. Any fees and/or commissions billed by Metric Financial, LLC are distinct from and in addition to fees billed by Bison Wealth, LLC.

Bison Wealth Form CRS | Form ADV Part 2 | Privacy Policy | Accessibility Statement