3550 Lenox Rd NE

Suite 2550

Atlanta, Georgia 30326

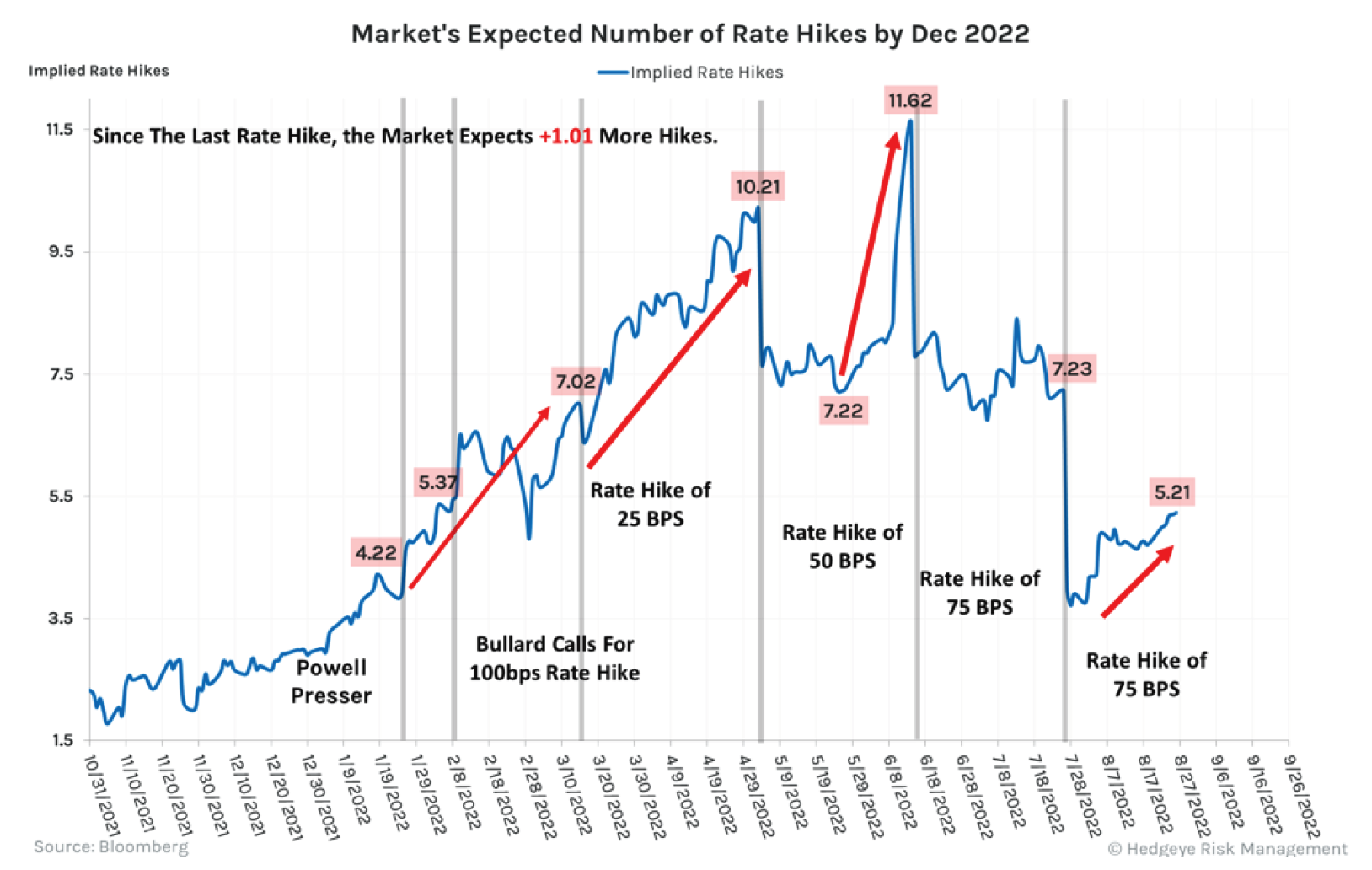

August brought a month of mixed results with stocks starting out strong, but then fading on increased volatility. For the month, the S&P 500 finished with a return of -4.08% and the aggregate bond index closed down -2.83%. At Bison, maintaining shorter duration fixed-income portfolios and lower volatility equity exposure has helped to mitigate the downside to our client portfolios. Entering the month of August, stocks continued a persistent and broad-based rally that began on June 16th with the S&P 500 Index rising 17% from its low point. This rally was bolstered by the belief that the Fed would ease their pace of interest rate hikes, despite no formal indication from the Fed of a course shift. Nonetheless, the stock market seemed to lose momentum toward the middle of the month, after Fed Chairman put to rest any notion that the Fed would be changing course anytime soon. Powell stated in no uncertain terms that households and businesses should expect to feel “some pain” as the Fed holds tight to its plan to fight inflation. His candid remarks certainly added to the volatility witnessed at the end of the month. The chart below indicates that market expectations for Fed rate hikes has jumped back up from end of July.

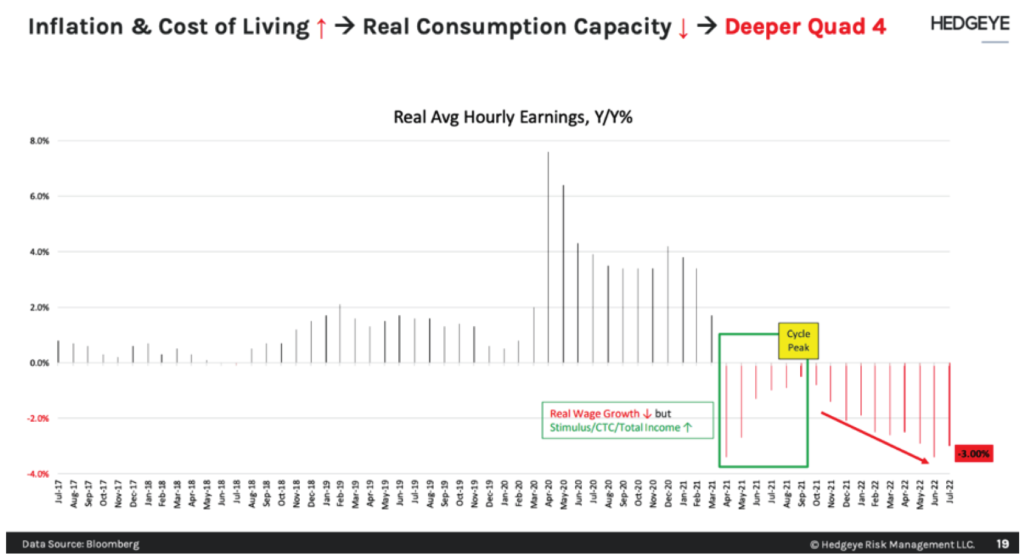

While many leading indicators of economic activity continue to demonstrate a deterioration in economic growth, there were a few mixed signals led by the July jobs report, indicating an above consensus number of new hires during July. This data was surprising, particularly in the midst of the current tightening of monetary policy. On the employment front, however, data on real wage growth and “number of jobs worked to make ends meet” was not quite as positive as the headline employment numbers indicated. The average person is having to work an all-time record number of jobs currently just to be able to pay their bills. The chart below depicts that real average hourly earnings have been on a steady decline for most of the year, showing mixed signals in the labor market.

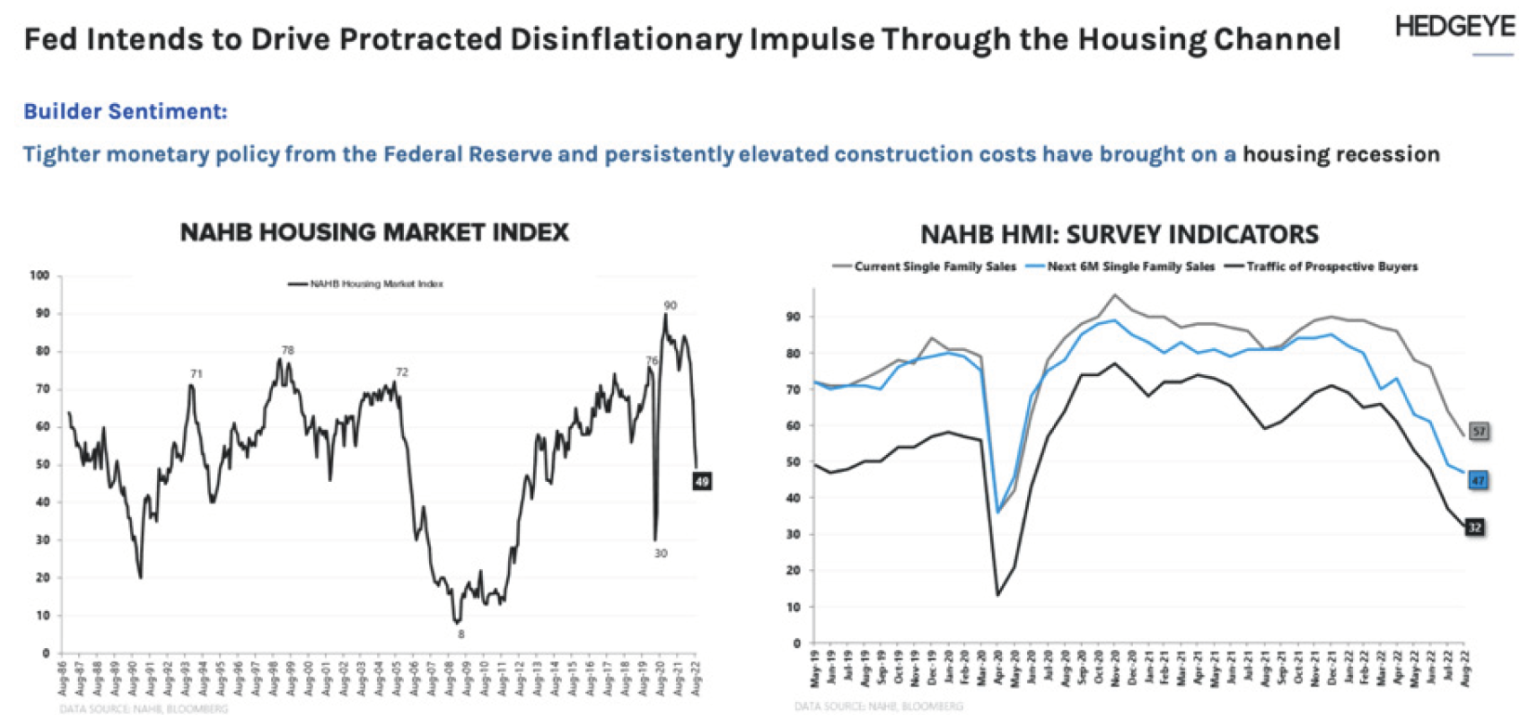

The housing market which, up until a few months ago, had been a steady driver of economic growth over the prior 18 months, has seen the negative effects of rising interest rates. The National Association of Homebuilders Index has seen a steep decline over the last few months, as housing turnover, new home construction, and mortgage applications have fallen off the proverbial cliff. The impact of housing on the economy cannot be underestimated; it was a critical driver of positive economic growth over the last 2 years, so it stands to reason that the opposite would hold true now that housing has rolled over.

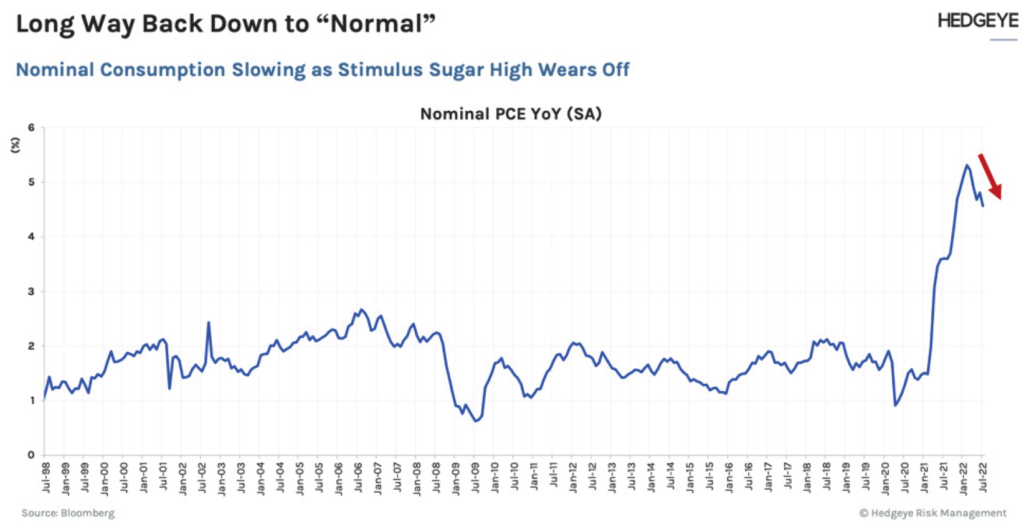

The consumer had previously been a pillar for strong economic growth. Since 2020, the consumer has been riding the covid stimulus wave lifting Personal Consumption Expenditures (PCE) to unsustainable growth, but now, the stimulus sugar high for the consumer is fading. PCE growth has been rolling over and that rate of change should continue to moderate for the foreseeable future.

U.S. inflation has, in all likelihood, peaked and should be trending downward, albeit, at a slow but steady pace. Furthermore, with higher inventories and less stress on the supply chain, this should also help to provide further relief to the inflation cycle. If we continue to see further contraction in economic growth and inflation begin to trickle down over the coming months, we should see longer-term rates come down and bond prices begin to recoup some of the downside that was experienced in the first half of the year. This reflects the importance of a balanced portfolio, where bonds can help protect the total portfolio should we see additional downside in the equity markets.

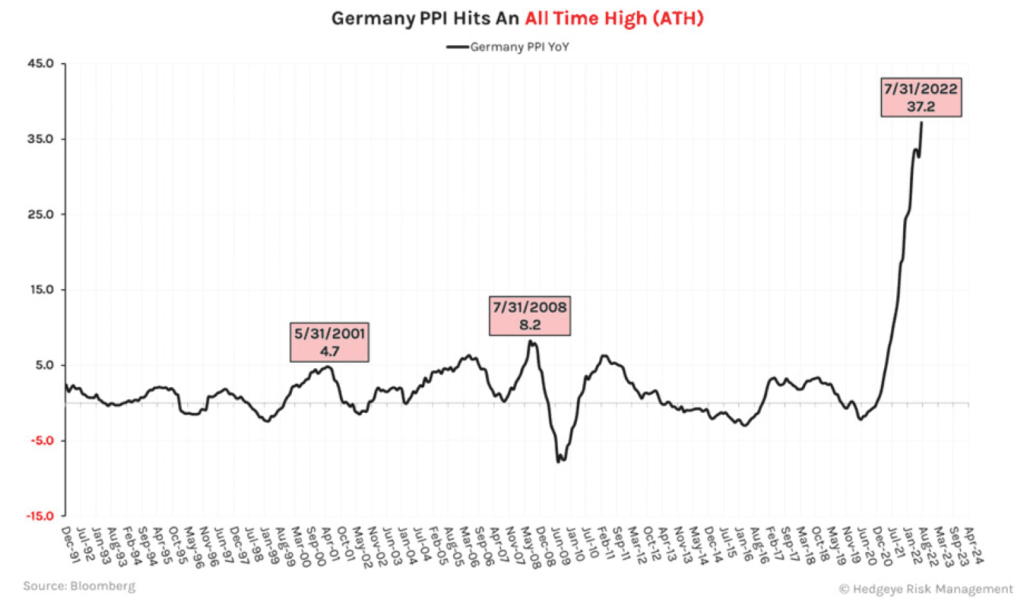

In the US, a very strong US dollar is also helping to dampen the impacts of global inflation. However, the grass is not greener on the other side of the pond in Europe and other parts of the world. In those regions, the strong dollar is having the opposite effect by exacerbating the impacts of inflation. In Europe, inflation clearly has NOT peaked. Consider some of the inflation data from Europe over the last couple of weeks:

The current environment is one where volatility should remain a constant companion for the foreseeable future. While the economy is clearly slowing from unsustainable levels of growth following the Covid period, the jury is still out on whether the US economy will fall into a recession. By the end of June, the markets had already experienced a 20% drawdown in the S&P 500, roughly two-thirds of the average bear market on an historical basis. So, while we could see a retracement or pullback of the recent price move and potentially more downside, a good chunk of the downside has already occurred, compared to historical averages.

Furthermore, a lot of the bad news may be already priced into the market, providing a reasonable belief that valuation throughout the stock market represents a stable floor. While the worst of this bear market could be behind us, we should not expect unbridled enthusiasm to follow until the Fed becomes more accommodative with monetary policy. Expect setbacks and normal back and forth trading ahead, as investors gain more clarity on the path of inflation within the Fed’s tightening program.

At Bison, we focus on wealth and financial planning and build portfolios based upon client objectives. As always, we believe that the best investment results are achieved by taking a long-term focus. Our goal is not to try to predict the market, but rather to develop risk-managed investment plans that can weather the difficult times and thrive during the upswings. The greatest long-term investors like Warren Buffet and Sir John Templeton never tried to time the market. That being said, our team is constantly measuring and mapping the financial markets data to incorporate changes that can improve the portfolio’s performance in both the good and challenging times. Maintaining discipline, patience, and an objective investment approach is the best way to meet the long-term objectives of our clients.

Investment Advisory services are provided through Bison Wealth, LLC located at 1201 Peachtree St. Ste 1950 Atlanta, GA 30361. Securities are offered through Metric Financial, LLC. located at 725 Ponce de Leon Ave. NE Atlanta, GA 30306, member FINRA and SIPC. Bison Wealth is not affiliated with Metric Financial, LLC., More information about the firm and its fees can be found in its Form ADV Part 2, which is available upon request by calling 404-841-2224. Bison Wealth is an independent investment adviser registered under the Investment Advisers Act of 1940, as amended. Registration does not imply a certain level of skill or training.

The statements contained herein are based upon the opinions of Bison Wealth, LLC (Bison) and the data available at the time of publication and are subject to change at any time without notice. This communication does not constitute investment advice and is for informational purposes only, is not intended to meet the objectives or suitability requirements of any specific individual or account, and does not provide a guarantee that the investment objective of any model will be met. An investor should assess his/ her own investment needs based on his/her own financial circumstances and investment objectives. Neither the information nor any opinions expressed herein should be construed as a solicitation or a recommendation by Bison or its affiliates to buy or sell any securities or investments or hire any specific manager. Bison prepared this Update utilizing information from a variety of sources that it believes to be reliable. It is important to remember that there are risks inherent in any investment and that there is no assurance that any investment, asset class, style or index will provide positive performance over time. Diversification and strategic asset allocation do not guarantee a profit or protect against a loss in a declining markets. Past performance is not a guarantee of future results. All investments are subject to risk, including the loss of principal.

Index definitions: “U.S. Large Cap” represented by the S&P 500 Index. “U.S. Small Cap” represented by the S&P 600 Index. “International” represented by the MSCI Europe, Australasia, Far East (EAFE) Net Return Index. “Emerging” represented by the MSCI Emerging Markets Net Return Index. “U.S. Aggregate” represented by the Bloomberg U.S. Aggregate Bond Index. “Treasuries” represented by the Bloomberg U.S. Treasury Bond Index. “Short Term Bond” represented by the Bloomberg 1-5 year gov/credit Index. “U.S. High Yield” represented by the Bloomberg U.S. Corporate High Yield Index. “Real Estate” represented by the Dow Jones REIT Index. “Gold” represented by the LBMA Gold Price Index. “Bitcoin” represented by the Bitcoin Galaxy Index.

3550 Lenox Rd NE

Suite 2550

Atlanta, Georgia 30326

Investment Advisory services are provided through Bison Wealth, LLC located at 3550 Lenox Road NE Suite 2550 Atlanta, GA 30326. Securities are offered through Metric Financial, LLC. located at 725 Ponce de Leon Ave. NE Atlanta, GA 30306, member FINRA/SIPC. Bison Wealth is not affiliated with Metric Financial, LLC. Bison Wealth is an independent investment adviser registered under the Investment Advisers Act of 1940, as amended. Registration does not imply a certain level of skill or training. Check the background of this investment professional on FINRA’s BrokerCheck. Bison Wealth, LLC does not offer tax or legal advice.

Investment adviser representatives affiliated with Metric Financial, LLC, a FINRA member broker-dealer, will earn commissions on certain investments. This presents a conflict of interest because the representative is incentivized to earn a commission. This conflict is mitigated, however, because you are not required to engage the IAR or Metric Financial, LLC to invest in securities. To the extent your IAR is affiliated with a broker-dealer, you may request copies of the Form CRS associated with the broker-dealer to better understand fees and services and how those fees and services differ from those provided by Bison Wealth, LLC. Any fees and/or commissions billed by Metric Financial, LLC are distinct from and in addition to fees billed by Bison Wealth, LLC.

Bison Wealth Form CRS | Form ADV Part 2 | Privacy Policy | Accessibility Statement